texas estate tax calculator

The property tax in texas applies to all real property and some tangible personal property in the state. Counties in Texas collect an average of 181 of a propertys assesed fair.

Texas Sales Tax Small Business Guide Truic

Ad From Fisher Investments 40 years managing money and helping thousands of families.

. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. An estate tax is a tax imposed on the total value of a persons estate at the time of their death. The median property tax on a 10180000 house is 184258 in Texas.

With few exceptions Tax Code Section 2301 requires taxable property to be appraised at market value as of Jan. At 210 the county also has the fifth-highest average effective property tax rate of Texas 254 counties. The median property tax on a 15710000 house is 284351 in Texas.

School districts are required to offer this exemption while counties. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. You might owe money to the federal government though.

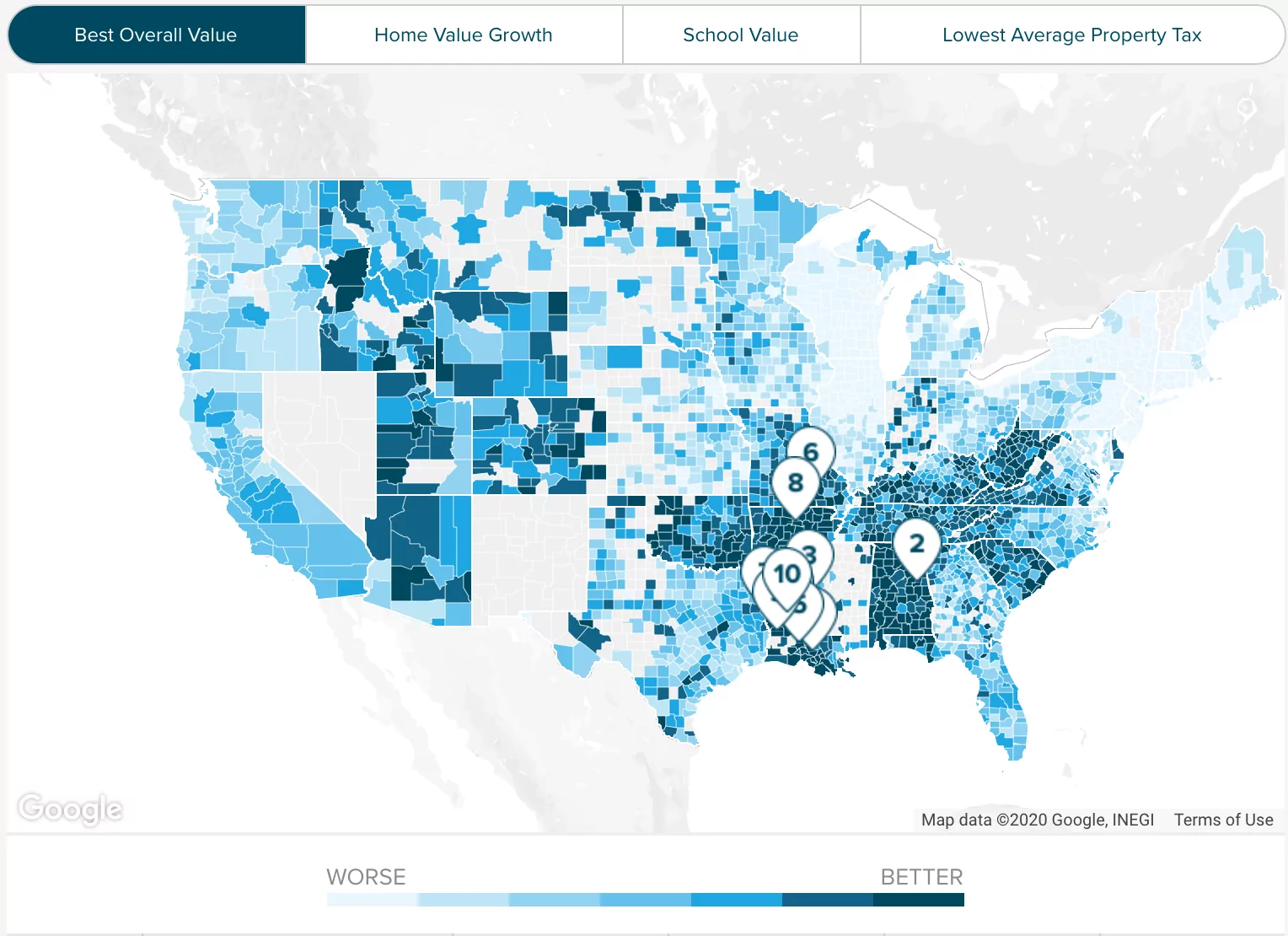

First we used the number of households median home value and. Texas has a 625 statewide sales tax rate but also has 815 local tax. Ad From Fisher Investments 40 years managing money and helping thousands of families.

This proration calculator should be useful for annual quarterly and semi-annual property tax proration at settlement calendar fiscal year. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The property tax in Texas applies to all.

The median property tax on a 15710000 house is 312629 in Montgomery County. Simply close the closing date with. The median property tax.

Use this Estate Tax Liability Calculator to determine potential federal estate tax liability for you and your heirs. Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. The annual tax assessed by.

For comparison the median home value in Texas is. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. It is sometimes referred to as a death tax Although states may impose their own.

The property tax is used to finance the States 254 counties over 1200 cities 1022 independent school districts and more than 1800 special districts. Federal Estate Tax. Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval.

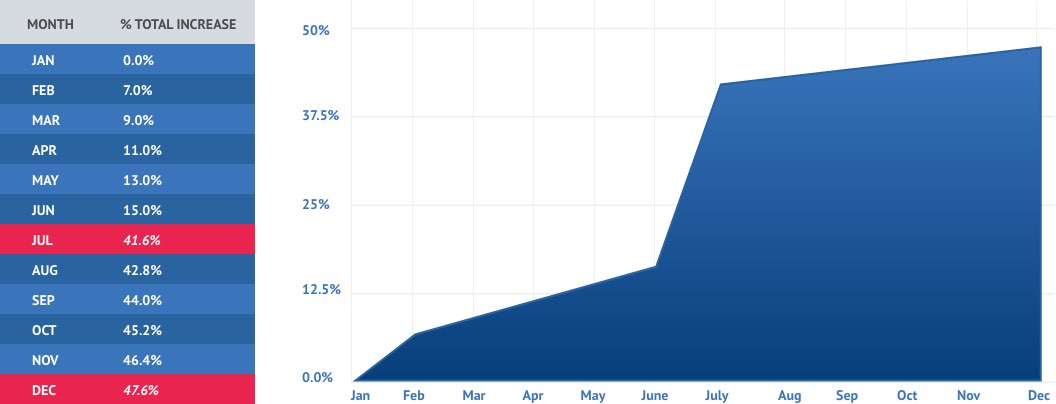

The entire tax bill for the previous year is payable in January. The most common property tax exemption in Texas is the homestead exemption which allows a rebate of at least 25000. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

Tax Code Section 1113 b requires school districts to provide a 40000 exemption on a residence homestead and Tax Code Section 1113 n allows any taxing unit to. Regardless of the size of your estate you wont owe estate taxes to the state of Texas. A key part of estate planning is helping reduce estate and inheritance tax.

Market value is the price at which a property would. The median property tax on a 10180000 house is 106890 in the United States. Texas has a 625 statewide sales tax rate but also.

Use the proration calculator to estimate the property taxes and homeowners association for the seller and home buyer.

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Sales And Use Tax Rates Houston Org

16417 Hill Country Dr Conroe Tx 77302 Har Com Real Estate Texas Real Estate Estate Homes

Ba Ii Plus Calculator On Mercari Finance Class Business Analyst Business Finance

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax Brackets

Texas Sales Tax Guide And Calculator 2022 Taxjar

Mobile Food Vendor City Of Fort Worth Texas Consumer Health Health Reviews

Property Tax How To Calculate Local Considerations

Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Get Our Image Of Real Estate Investment Analysis Template Mortgage Comparison Investment Analysis Income Property

Pin On San Angelo Texas Homes Information

Harris County Tx Property Tax Calculator Smartasset

What Is Estate Planning Basics Checklist For Costs Tools Probates Taxes Estate Planning Estate Planning Attorney Estate Tax

Calculate Child Support Payments Child Support Calculator 2015 Child Support Calculator Childsuppor Child Support Quotes Child Support Child Support Laws